XRP ETF SHOCK $11 BILLION Inflows Coming HUGE Market Shift REVEALED

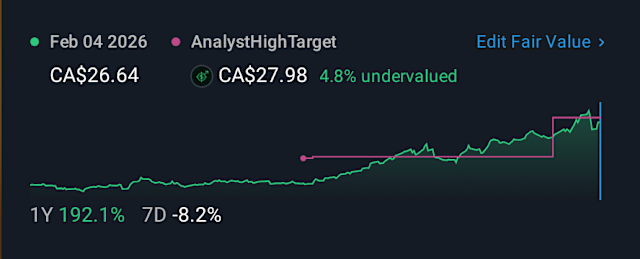

Could your crypto portfolio be on the verge of a seismic shift? Six spot XRP ETFs are poised for SEC approval, with final deadlines looming in October, promising to fundamentally reshape the XRP market. Experts now agree it’s a matter of 'when,' not 'if,' these transformative products launch, though a federal shutdown has momentarily paused proceedings. Once operations resume, financial titans like Bitwise, Grayscale, and JPMorgan are ready to unleash billions, with market researchers projecting a staggering $4 billion to $11 billion in first-year inflows, absorbing up to 4% of XRP’s circulating supply! However, a 'sell the news' event, mirroring Bitcoin’s and Ethereum’s ETF debuts, is highly probable, potentially causing immediate price dips that could rattle even seasoned investors. But don't despair; these ETFs are set to become structural 'supply absorbers,' fundamentally altering XRP’s liquidity and price discovery by capturing inventory inside funds. This isn't just about new money; it’s about a complete re-plumbing of the market, shifting power from crypto-native cycles to advisor and retail allocations. Your investments could be entering a critical new era. For more insights into how these changes will impact your holdings, make sure to subscribe to our channel!

Tags/Hashtags: #xrp #etf #sec #cryptocurrency #grayscale #sec #bitwise #21shares #wisdomtree #coinshares #grayscale #cboe #cryptoquant #bitget #jpmorgan #k33 #glassnode

Leave a Reply