SHOCK! BitMine Owns 2.5% ETH Supply: $15,000 Price Target?!

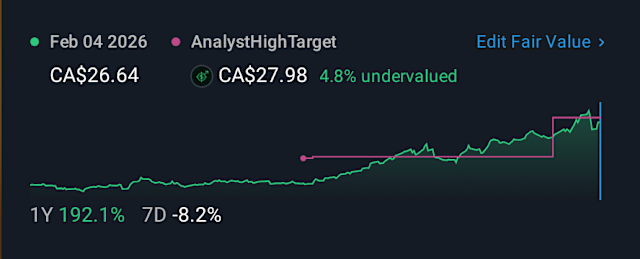

Imagine a single entity now controls a staggering 2.5% of *all* Ethereum in existence – what does this mean for your financial future? Tom Lee's BitMine has embarked on a jaw-dropping buying spree, accumulating another $281 million in ETH during recent market dips, bringing their total holdings to a monumental $12.9 billion. This isn't just speculative trading; it's a calculated move. Blockchain analytics confirm other massive investors are also quietly gobbling up Ethereum, pulling over 400,000 ETH into cold storage, as exchange reserves hit a three-year low. This signals a unified conviction that Ethereum is poised for explosive growth, with institutional holdings now exceeding 10% of the total supply. Visionaries like Tom Lee foresee ETH soaring to $15,000 by 2025, driven by its expanding dominance in tokenization, DeFi, and AI infrastructure, predicting a genuine supply squeeze. Former BitMEX CEO Arthur Hayes even forecasts $10,000 before year-end as macro conditions improve. These strategic purchases, made when the market faltered, are more than just smart; they're fortifying investor confidence and establishing Ethereum as the undeniable infrastructure layer for a new financial era. For those paying attention, every market dip is not a danger, but an unmissable discount. Don't let these groundbreaking insights pass you by – subscribe to our channel for more critical financial analyses!

Tags/Hashtags: #ethereum #bitmine #cryptocurrency #investing #blockchain #defi #bitmine #falconx #bitgo #whalemap #arkham #ethereum #bitmex

Leave a Reply