SCHD vs. QQQI: Monthly Cash NOW or Massive Growth? 1 Choice Changes EVERYTHING!

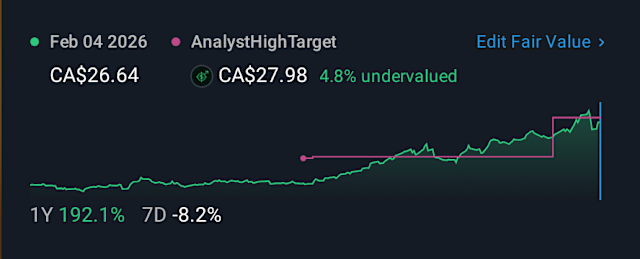

Are you sacrificing long-term financial freedom for immediate cash flow? Investors face a critical choice between dividend growth and frequent, potentially higher, dividend yields from exchange traded funds like SCHD and QQQI. While the Schwab U.S. Dividend Equity ETF, known as SCHD, offers diversified exposure to dividend growers such as Home Depot and Coca-Cola, delivering strong long-term growth and a 3.74% trailing yield quarterly, QQQI appeals with the promise of more frequent monthly distributions, tempting those who prioritize immediate income. Understanding these crucial differences is vital for picking the best fund for your portfolio and securing your passive income future. Discover which strategy aligns best with your goals by subscribing to our channel for more expert insights into optimizing your investments.

Tags/Hashtags: #schd #qqqi #etf #dividends #investing #schwab #schd #qqqi #chevron #schwab

Leave a Reply