MRVL Stock: 38% Undervalued?! Why 13,000 Put Options Are a BULLISH Signal NOW!

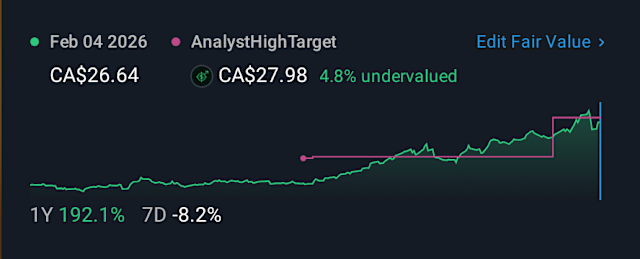

How can a company projected to be 38% undervalued experience massive put option activity betting on a significant stock drop? Marvell Technology, a robust system-on-a-chip designer, recently announced an AI-focused acquisition and boasts impressive free cash flow margins. Despite these strong fundamentals, including a 37% year-over-year revenue increase, MRVL stock is currently down, coinciding with unusual volume in out-of-the-money put options predicting a 17% fall. However, this heavy put options trading is more likely a strong bullish signal, as many investors are shorting these puts to gain cheap entry points and generate income. Uncover more surprising market insights by subscribing to our channel for daily investment analysis.

Tags/Hashtags: #investing #undervalued #ai #acquisition #mrvl

Leave a Reply