Harvard’s SHOCKING 257% Bitcoin Bet: What They Know That YOU Don’t!

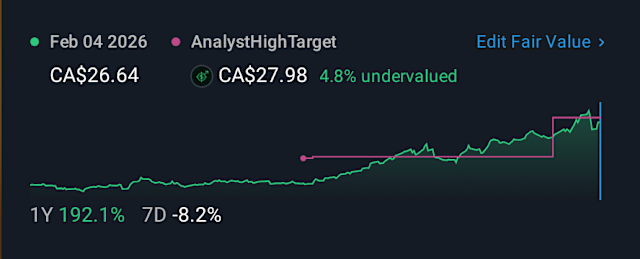

Did Harvard just make a colossal mistake, or are they seeing something the rest of us are blind to? In a stunning move that has financial titans buzzing, Harvard University dramatically increased its BlackRock Bitcoin ETF holdings by a jaw-dropping 257%, bringing its stake to nearly half a billion dollars – making it their top investment! This monumental bet comes amidst a period of heart-stopping Bitcoin volatility and record-breaking outflows from spot ETFs, leaving many wondering if the venerable institution has gone mad. But this isn't just about Bitcoin; Harvard simultaneously doubled down on gold, suggesting a profound strategy for inflation or currency risk that your wallet can't afford to ignore. While many retail investors panic, the smart money is pouring in, with over 1,300 funds, including giants like Millennium Management and Goldman Sachs, quietly accumulating BlackRock’s IBIT. They likely see long-term supply constraints, maturing regulatory frameworks, and a critical hedge against global uncertainty. This isn't short-term speculation; it's a deep conviction in Bitcoin's future. What cosmic secret has Harvard uncovered that eludes the masses? Don't be left behind when the financial landscape shifts; ignoring these seismic movements could mean your wallet might never recover! Make sure to subscribe to our channel to stay ahead of these crucial market insights.

Tags/Hashtags: #bitcoin #ibit #blackrock #cryptocurrency #etf #gold #blackrock #macroscope

Leave a Reply