Ethereum ETFs EXPLODE! $287M Inflow After 4-Day Dump!

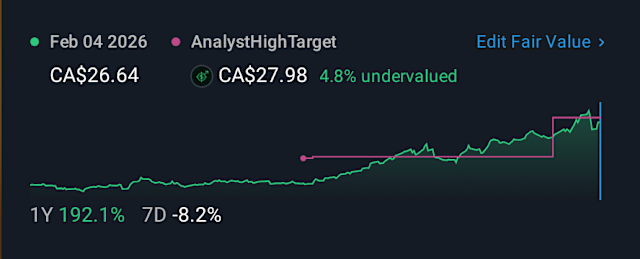

Could Ethereum ETFs be the key to unlocking future financial stability? After four days of nail-biting outflows exceeding $925 million, Ethereum-focused ETFs staged a dramatic comeback, attracting a whopping $287 million in inflows. Leading the charge was BlackRock's iShares Ethereum Trust (ETHA), scooping up a lion's share of $233.5 million, followed by Fidelity's FETH with $28.5 million. This resurgence pushed total ETF inflows past a staggering $12 billion, with assets nearing $27 billion. Interestingly, total Ethereum ETF holdings hit a record high of 6.069 million ETH on Aug. 19, up a jaw-dropping 46% in just six weeks. Market analysts suggest this signals a shift towards long-term Ethereum investments, but warn of potential price volatility due to decreased spot market liquidity. This concentration of ETH in ETFs is a double-edged sword: sustained demand creates a bullish foundation, but a slowdown in purchases could trigger selling pressure, impacting your investments. Subscribe to our channel to stay ahead of these market swings and protect your portfolio!

Tags/Hashtags: #ethereum #etfs #inflows #outflows #blackrock #fidelity #ishares #etha #feth #crypto #investment #market #volatility #liquidity #blackrock #fidelity #feth #bitwise #ethw #vaneck #ethv #grayscale #cryptoonchain #ethereum

Leave a Reply