Corporate Bitcoin SHOCKER: 39% of Companies Hiding MASSIVE Debt! 27% Crash EXPOSED!

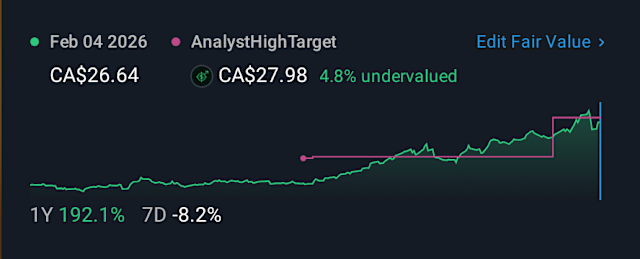

Your wallet might never recover if you're not paying attention! Did you know that a staggering 39% of companies flaunting Bitcoin on their balance sheets are actually drowning in *more debt* than their crypto is worth? For years, investors have blindly treated corporate Bitcoin holdings as an undeniable sign of conviction, a simple premium for their stock. However, a groundbreaking CoinTab dataset shatters this illusion, revealing a hidden liability crisis lurking beneath the surface of these seemingly robust portfolios. Shockingly, the recent market dip, where Bitcoin slid from $122,000 to $107,000, unmasked these companies for what they truly are: highly leveraged bets, not simple proxies. This triggered an average 27% crash in their share prices, a brutal structural response to debt loads suddenly pulling in the opposite direction from their volatile assets. Many firms even used borrowing to *directly acquire* Bitcoin, transforming a treasury strategy into a high-stakes gamble that backfired dramatically. This isn't just about Bitcoin; it's about the dangerous interplay between volatile assets and crushing debt that investors routinely overlook. Ultimately, treating all corporate Bitcoin holders as uniform 'Bitcoin plays' is a perilous mistake, exposing your portfolio to unseen credit risks. So, before you invest, look beyond the shiny crypto and scrutinize the full balance sheet – it could save you from financial devastation. For more critical insights like this, make sure to subscribe to our channel!

Tags/Hashtags: #bitcoin #cryptocurrency #debt #liabilities #investing #leverage #cointab #cointab #bitcointreasuries

Leave a Reply