Bitcoin’s $63 BILLION Secret: Fallen Angels Could Ignite Market Chaos!

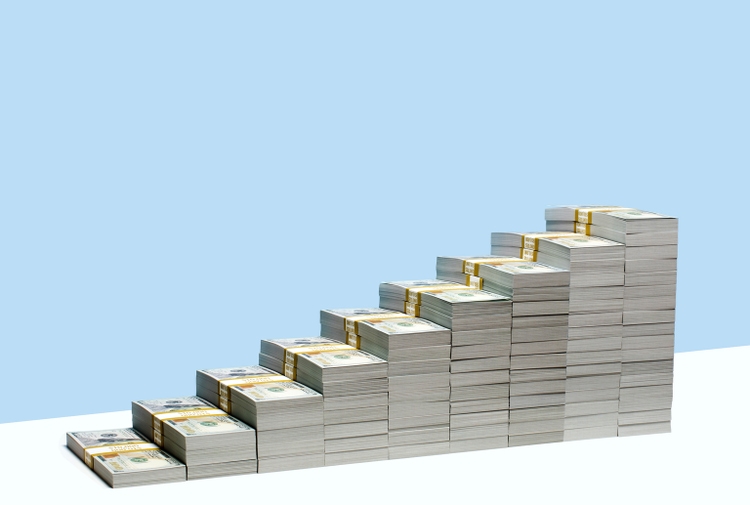

What if a hidden $63 billion debt bomb is about to trigger chaos in your portfolio and supercharge Bitcoin? Beneath a deceptively calm market surface, a terrifying truth is emerging: corporate credit quality is rapidly deteriorating, with a staggering $63 billion in investment-grade debt teetering on the edge of junk status, a phenomenon most investors are tragically ignoring. This lurking crisis of "fallen angels" could initially send Bitcoin plummeting as financial conditions tighten and risk appetite vanishes. However, don't despair! Historically, if this credit stress escalates enough to force the Federal Reserve's hand, triggering rate cuts or liquidity backstops, Bitcoin could experience a jaw-dropping reversal. Remember 2020, when a similar Fed intervention propelled Bitcoin from $4,000 to over $60,000 within a year. This isn't a safe haven argument, but a potent rotation story: as traditional credit assets falter, Bitcoin, devoid of credit risk, could become an unexpected champion. The stakes are immense, and understanding this two-stage mechanism is crucial for your financial future. Stay ahead of the curve – subscribe to our channel for more critical insights that could save your wallet!

Tags/Hashtags: #bitcoin #liquidity #investing #cryptocurrency #jpmorgan #bitcoin

Leave a Reply