ARES SHOCKER! Q4 Missed, But AI Bets & $157 Target Make it a ‘Strong Buy’ NOW!

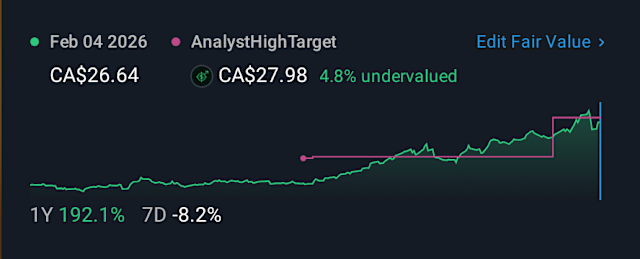

Did you know a major financial firm recently missed analyst revenue forecasts yet received a significant stock upgrade? Ares Management Corp, despite falling short on Q4 2025 EPS and revenue expectations, boasts an astounding $600 billion in assets under management and $150 billion in dry powder. CEO Michael Arougheti is aggressively expanding into AI, private credit, and digital infrastructure, targeting impressive 16-20% annual fee-related earnings growth. Crucially, Raymond James upgraded ARES to a Strong Buy, setting a $157 price target, citing predictable growth from over $100 billion in non-fee-earning assets and a solid 4.1% dividend yield. For insights into which firms are truly poised for future success, consider subscribing to our channel.

Tags/Hashtags:

Leave a Reply